The uncertainties of immigration for 2025

While the political uncertainty following the dissolution of the National Assembly on 7 July 2024 seems to be resolved with the appointment of a new Prime Minister, uncertainties persist for the year 2025 concerning four sometimes little considered areas of International Mobility. Our dedicated teams responsible for tax registrations, apostilles and legalizations as well as professional immigration procedures take stock/evaluate the current situation/circumstances.

The uncertain competence for apostilles and legalizations

Often little known, the procedure for legalizing a document is nevertheless central to enabling other procedures to be carried out (visa application, social security affiliation, etc.). It then consists of affixing a seal on it, attesting to the authenticity of the signature of the author of the document as well as its function. This legalization by the Ministry of Foreign Affairs must also be supplemented by legalization by the Embassy or Consulate of the recipient country in France.

When the country receiving the document adheres to the 1961 Hague Convention, the document can be apostilled. This is a simplified authentication procedure, in the form of a “stamp”, dispensing with legalization by the Embassy or Consulate of the recipient country.

Thus far, requests were made only in paper format. The legalization office of the Ministry of Foreign Affairs was responsible for legalization requests, while the apostille was affixed by the Court of Appeal.

Initially scheduled for 1 September 2023, the entry into force of the reform announced by Decree No. 2023-25 of 23 January 2023 "the objective of modernizing administrative procedures linked to the authentication of French documents intended for foreigners" had been postponed to 1 January 2025.

The new reform plans to:

- Transfer the competence to legalize and apostille documents to notaries

- Simplify the application procedure by dematerializing it

- Centralize requests on a dedicated platform

- Create a national database of public signatures

With a Ministerial Decree dated 23 December 2024, the reform has been postponed, respectively to 1 May 2025 for Apostilles, and to 1 September 2025 for Legalisations.

Our teams are ready to adapt to these new skills and tools, maintaining daily contact with the administrations in order to ensure the most reliable and rapid service possible.

The uncertain scope of tax registration

With the entry into force of the withholding tax reform on 1 January 2019, Home Conseil Relocation has set up a tax registration service to allow first-time tax filers (foreigners impatriated to France or even French nationals returning from a long expatriation) to accomplish a double objective:

-

Proactively make yourself known to the SIP (Individual Tax Services) to obtain a tax number and access to the personal online account

-

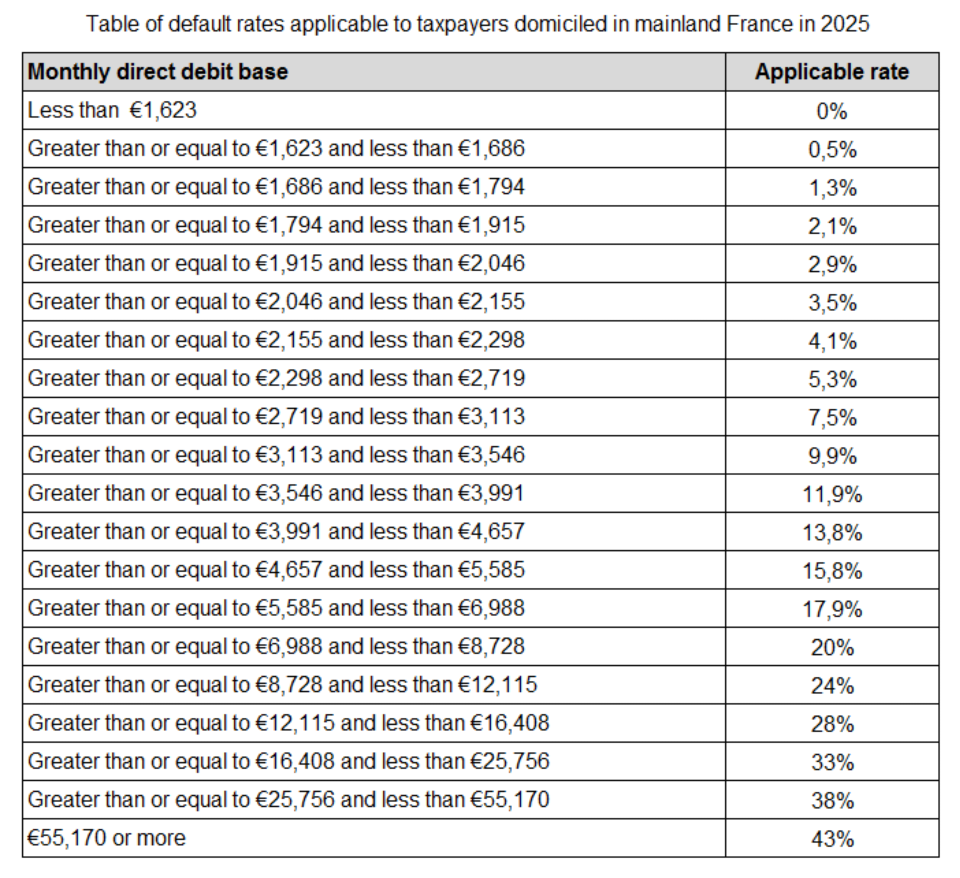

Adjust their withholding tax rate, the “default” rate applied by the FISC being the highest rate applicable to the range of their income declared via the DSN by their employer

Recently, however, our teams have observed a change in the way the FISC takes applications into account, prompting us to remain vigilant for the year 2025.

In fact, some SIPs (Individual Tax Services) refuse to grant a tax number and a personalized tax rate to people who are single or “do not have sufficient income”. Although this type of decision is not yet generalized to all SIPs, we have some reservations about the success of this assistance for single people.

Furthermore, our teams have cross-referenced the different profiles and identified the conditions (in particular the income) allowing or not to benefit from a personalized tax rate and a tax number in advance, the final decision however remaining with the tax administration.

That's why our support for tax registration is evolving in 2025 by now offering (at no extra cost to our customers) a preliminary study of each case to assess the chances of success of the procedure in relation to the practices of each SIP.

The uncertain dematerialisation of immigration procedures

Almost five years after the digitalisation of immigration procedures with the start of the deployment of ANEF (Digital Administration for Foreigners in France) and three years after the entry into force of the decree of 24 March 2021, extending the teleservice to statuses other than students, the Defender of Rights (Défenseur des Droits-DDD) has received an increased number (+400% in four years) of complaints.

Many of these complaints concern problems with the organisation of the prefectural services, the practices of the prefectures and the inadequate resources of the foreign nationals' offices, many of which affect nationals who have been legally resident in France for many years, some of whom hold 10-year residence permits.

Faced with this situation, on 11 December 2024 the Defender of Rights issued a critical report on the implementation of the ANEF platform, noting that the ANEF platform had not been sufficiently tested prior to its implementation and that its deployment had therefore been too hasty.

This report describes the following problems:

- Technical problems: inability to respond to requests for additional documents, to download certificates of positive decision or extension of assessment, or to change password or email address.

-

Readability problems: The fragmented deployment of supported statuses lacks readability. It can therefore be complicated to know whether the process should be submitted to the ANEF or through another means.

-

Problems with the certificates issued: unfortunately, the certificate extending the investigation is not issued automatically, and the Prefectures do not receive automatic reminders before a foreign national's rights expire. Our teams have encountered many situations where the person was in an irregular situation because they had not received the certificate in time. Certificates of extension of investigation and favourable decision also suffer from a lack of legal recognition by other administrations (Social Security, France Travail). The Defender of Rights notes a lack of coordination between their codification in the CESEDA and in other texts relating to Social Security and France Travail. As a result, some nationals are denied the rights for which they are eligible.

- Problems of insufficient alternative solutions: Although the Council of State partially annulled the decree of March 2021, by a decision of 3 June 2022, by requiring the implementation of alternative solutions in the event that a deposit on the ANEF was impossible, it is very often very complicated to obtain one. Indeed, it was not until 4 August 2023 that users were able to avail themselves of this right, pending the adoption of similar texts.

Faced with these shortcomings, the Defender of Rights has issued fourteen recommendations aimed at protecting the rights of foreign nationals and making the ANEF more effective, such as:

- Incorporating into the CESEDA a provision recognising the right to make any application via a non-dematerialised channel, without any prior conditions;

- Modifying the online service so that users can carry out several procedures simultaneously, rectify, complete or cancel a request, keep a complete history and be kept informed of the progress of their request;

- Enabling instructing officers to resolve technical problems as far as possible and to reopen closed files when necessary;

- Improving the use of dematerialised certificates to better guarantee the rights attached to them, in particular by implementing the automatic renewal of certificates extending the investigation period (and extending their duration to 6 months);

- Providing each Prefecture with a support service that can be contacted by telephone to direct users to the most appropriate filing method for their situation;

- Strengthening the human resources allocated to the Prefectures on a long-term basis.

Given the uncertainty surrounding the processing of applications for residence permits linked to the electronic system and ANEF, our Immigration team continues to be in contact with the Prefectures in order to quickly find alternative solutions to any problems encountered.

The uncertain implementation of a CPAM platform dedicated to inactive people

Back in 2018, we wrote about the unexpected difficulties for expatriates returning to France in obtaining health coverage. This issue concerns the European and French insured spouses, who are themselves inactive and accompany the employee on a stable and regular basis.

Our CPAM team at Home Conseil Relocation recently noted the introduction of a platform dedicated solely to inactive non-French European spouses.

Although the contours of this platform have not yet been officially specified by the government, our first look at it confirms that it brings together both the ‘classic’ affiliation procedure and the much longer and more complex procedure of searching for rights within the EU, handled by the CREIC.

Our teams remain vigilant on this complex issue, and the provided assistance, as it is all the more important in this context of dematerialisation, which is conducive to gaps in coverage.

Conclusion

Our teams dedicated to tax registration, CPAM affiliation, apostilles and legalisation and to professional immigration procedures are constantly monitoring these vital issues to ensure that international mobility to France takes place under serene conditions. We will continue to inform our clients at Home Conseil Relocation about future developments in these areas, so don't hesitate to contact us if you have any questions!